This spring, 6th grade students at City Springs Elementary / Middle School learned much more than reading, writing, and arithmetic. Thanks to T. Rowe Price’s Money Confident Kids Financial Literacy Curriculum, a financial literacy program geared for middle school students, they learned about budgeting, saving, earning interest, and more critical financial lessons.

The innovative, interactive program taught by T. Rowe Price education volunteers and financial experts began on February 28 and concluded for the 2024-2025 school year on June 6 with a review lesson, TRP swag bags, a pizza party, and a visit from the Oriole bird to celebrate their achievements.

“City Springs is the first school where we have resurrected our financial literacy outreach since COVID,” explains Sabrina Thornton, a member of the Community Investment team at T. Rowe Price, who coordinates the program. “We used to do a train-the-trainers model before the pandemic with classroom teachers sharing the content.”

As Ms. Thornton was determining how to re-launch the program, Rob Sharps, T. Rowe Price CEO and Baltimore Curriculum Project (BCP) Board member, suggested a partnership with City Springs and BCP. After an enthusiastic phone call with Dr. Rhonda Richetta, City Springs Principal, a plan quickly coalesced.

As Ms. Thornton was determining how to re-launch the program, Rob Sharps, T. Rowe Price CEO and Baltimore Curriculum Project (BCP) Board member, suggested a partnership with City Springs and BCP. After an enthusiastic phone call with Dr. Rhonda Richetta, City Springs Principal, a plan quickly coalesced.

How T. Rowe Price’s Money Confident Program Works

First, Ms. Thornton sent T. Rowe Price’s Money Confident Kids curriculum to the 6th grade team for review. The teachers gave it a thumbs-up, and T. Rowe Price volunteers began planning the schedule.

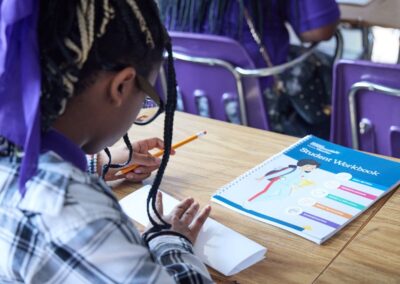

Each student received a workbook, which bases every lesson around Nicky, a fictitious young person navigating different time periods in her life (first job, buying a car, paying for college, first apartment, etc.) and different financial decisions that she needs to make with each step. Students follow Nicky on her journey, helping to figure out what the best financial decision for her to make in those scenarios.

“Our lessons walk them through how to make good judgments on those decisions and give them the tools, knowledge, and types of questions to ask to make those decisions,” adds Ms. Thornton. The first lesson was about a party Nicky was planning. Students brainstormed how she could make extra money – babysitting, dog-walking, etc. – and how Nicky could create a budget for the party based on her income. “It’s a basic lesson that explains how to save, which has implications for saving for a car and other decisions,” Ms. Thornton says. Lessons include conversations about needs vs. wants, inflation and the cost of goods and balancing a part-time or full-time job with going to college, “very real-world applicable experiences,” she adds.

The real world comes with many financial complexities for students, right now and in the future. Ms. Thornton describes several predatory practices on young people for credit cards, for example. “These things can seem exciting and tempting to young people as early as sixth grade,” she says. “The fine print is never really spelled out for them. This program is a way to have students and young people think more clearly about how to protect themselves financially and make sound decisions. It removes the stigma that it’s not polite to talk about money. It’s great to talk about money. I got into way too much credit card debt as a young 20-year-old, and it took me a long time to get out of it.”

The real world comes with many financial complexities for students, right now and in the future. Ms. Thornton describes several predatory practices on young people for credit cards, for example. “These things can seem exciting and tempting to young people as early as sixth grade,” she says. “The fine print is never really spelled out for them. This program is a way to have students and young people think more clearly about how to protect themselves financially and make sound decisions. It removes the stigma that it’s not polite to talk about money. It’s great to talk about money. I got into way too much credit card debt as a young 20-year-old, and it took me a long time to get out of it.”

During a lesson on interest rates, City Springs teachers helped T. Rowe Price volunteers to connect the Money Confident Kids content to other topics they were learning about in social studies, like spatial inequality, home loans, redlining, and predatory practices.

City Springs’ Money Confident 6th Graders

Ms. Thornton and the T. Rowe Price volunteers were thrilled with the enthusiasm the 6th grade had for the workbook and program: “They had opinions and ideas each time we were in the classroom, with real goals around what they would do when they start saving. Whenever you ask students to take out a calculator, some will tune out, but because we were able to use games to teach the lessons and make it applicable to their day-to-day lives, they really got into it.”

The heart of the Money Confident Kids program is empowerment for students to feel comfortable talking about money and having confidence in their power to manage their money and make smart decisions. On June 6, each student received a graduation certificate for matriculating through the five lessons.

Ms. Thornton and her colleagues are hoping to return to City Springs next fall to provide the program to the rising 6th grade class. They also hope to introduce the program to a handful of other City Schools.

“Helping people plan for a sound and stable financial future is our ethos at T. Rowe Price,” Ms. Thorton explains. “For our associates who are in the classroom at City Springs, this is truly a special experience to be able to work with the kids and see the light bulbs going off. For us, it’s that connection between the work that we do every day and its actual impact on someone’s life.

Thank you, T. Rowe Price, for sharing this amazing program with BCP and City Springs! And thank you, T. Rowe, for your incredible, continued generosity as a Platinum Sponsorship of our annual “Are You Smarter Than a BCP Student?” gala.

A very special thanks to the T. Rowe Price associates who volunteered their time and talent with our students:

Benjamin Ballard

Ashley Bell

Suzanne Cho

Alexis Cisek

Thomas Dignacco

Josephine Dujale-Smith

Alyssa Janus

Matthew Menter

Ulla Pitha

Katie Pizak

Benjamin Rubin

Girija Sriraghavananda

Jason White

Photo Gallery